The Indian aviation sector has long been a challenging market, often described as a “graveyard” for airlines. Regulatory complexities, high operating costs, fluctuating fuel prices, and fierce competition have left many carriers struggling to stay airborne. Iconic names like Kingfisher Airlines, Jet Airways, GoAir, and now the merger of Vistara with Air India stand as testaments to the volatility of this industry. Amidst this turbulence, IndiGo’s meteoric rise—and now its potential stumbles—adds an intriguing chapter to this saga.

The Indian aviation industry is witnessing significant growth, driven by the expanding middle class and increasing demand for flight connectivity. In FY2024, domestic passengers reached 306.7 million, reflecting a robust 13.5% year-on-year (YoY) growth. The international market recorded 69.64 million passengers, with an impressive 22.3% YoY growth (IBEF). India has now surpassed Indonesia and Brazil to become the third-largest domestic aviation market globally.

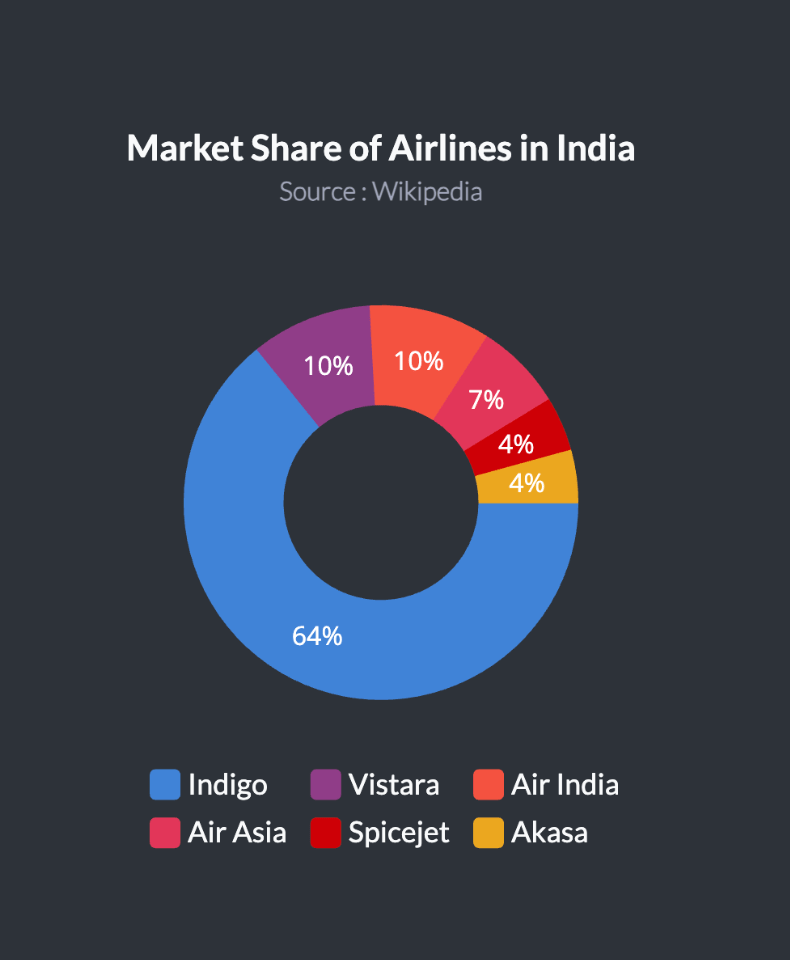

However, only a handful of major players dominate the current market. The graph below highlights the key players and their respective market shares.

To understand how the Indian aviation landscape evolved, it is essential to examine the rise and fall of past airlines. Kingfisher Airlines, launched by Vijay Mallya in 2005, and IndiGo, founded in 2006, entered the market around the same time. Kingfisher’s motto, “Fly the Good Times”, failed to resonate due to its king-size prices and operational inefficiencies. Indian consumers, being highly price-sensitive, preferred cost-effective options, even opting for inconvenient flight timings to save money. This misjudgment of market needs was a major misstep for Kingfisher and, later, Jet Airways.

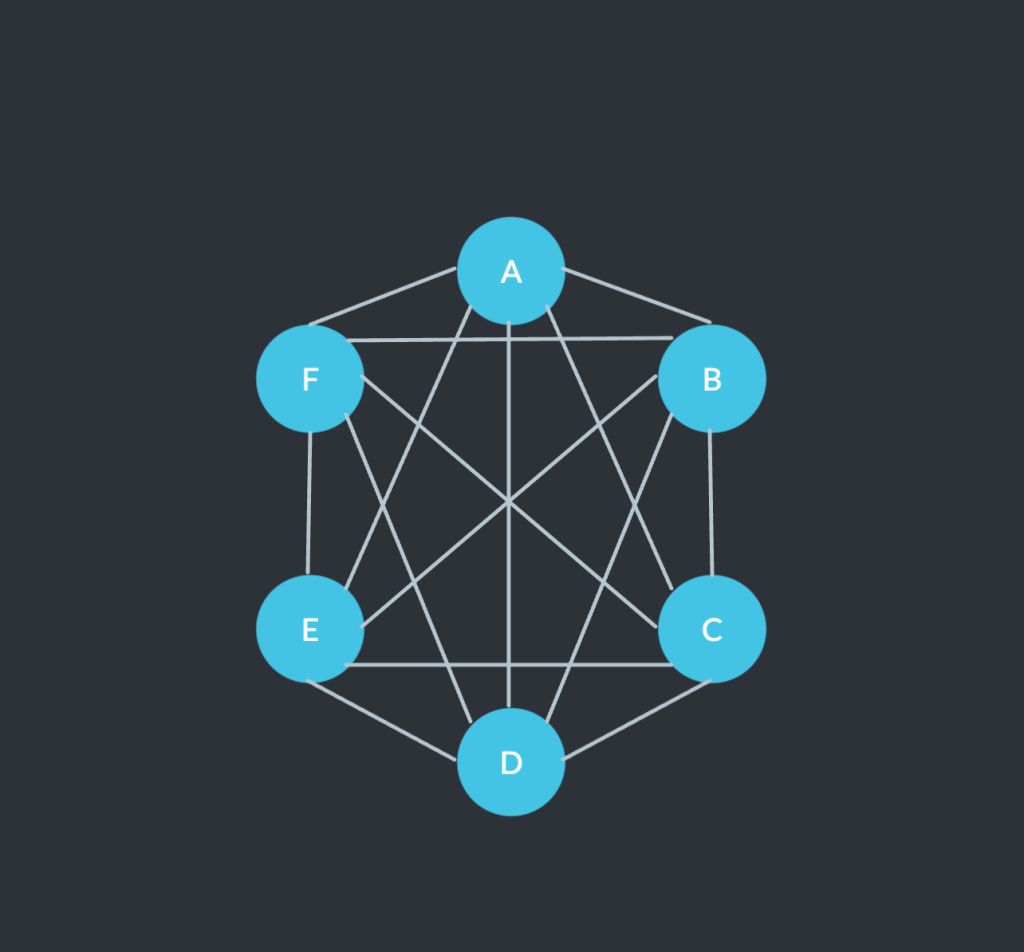

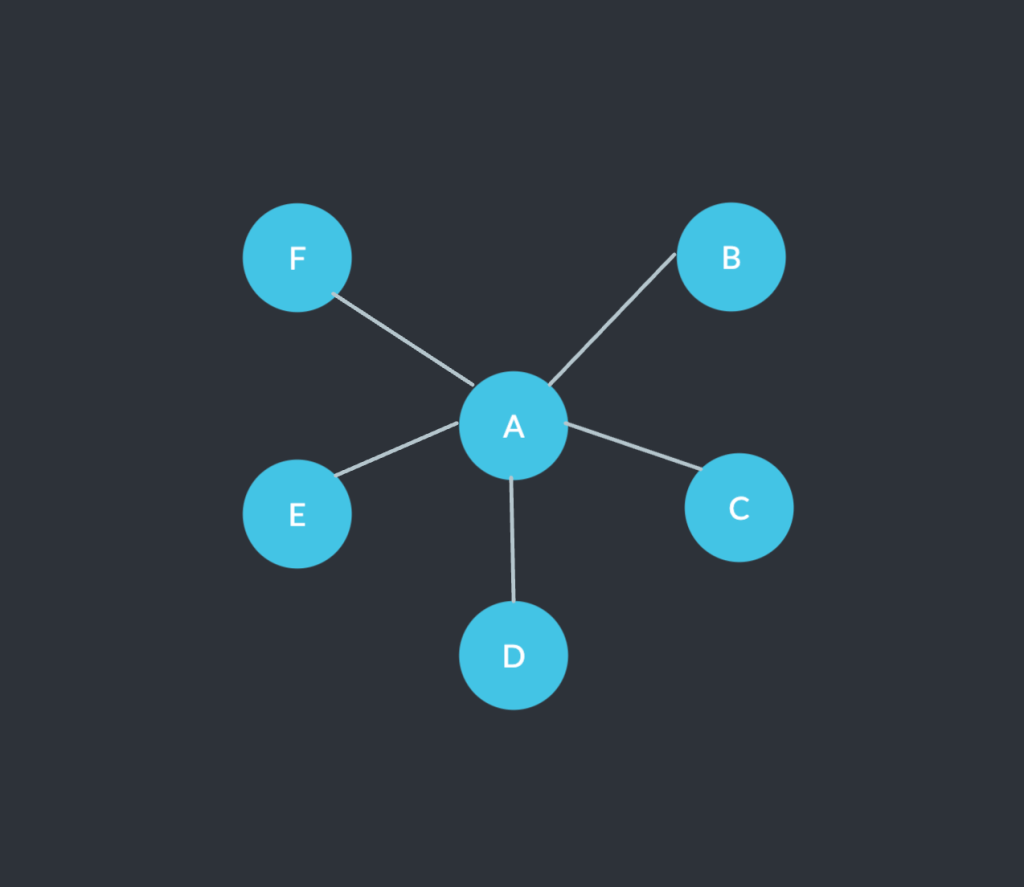

Through a Kingfisher lens, its attempt to operate multiple hubs with premium offerings was unsustainable, given the high costs and operational inefficiencies. By contrast, through an IndiGo lens, the hub-and-spoke model thrived in the Indian market. IndiGo’s centralized hubs in Delhi and Mumbai optimized operations, maximizing fleet utilization and offering affordability—a winning strategy in a price-conscious market.

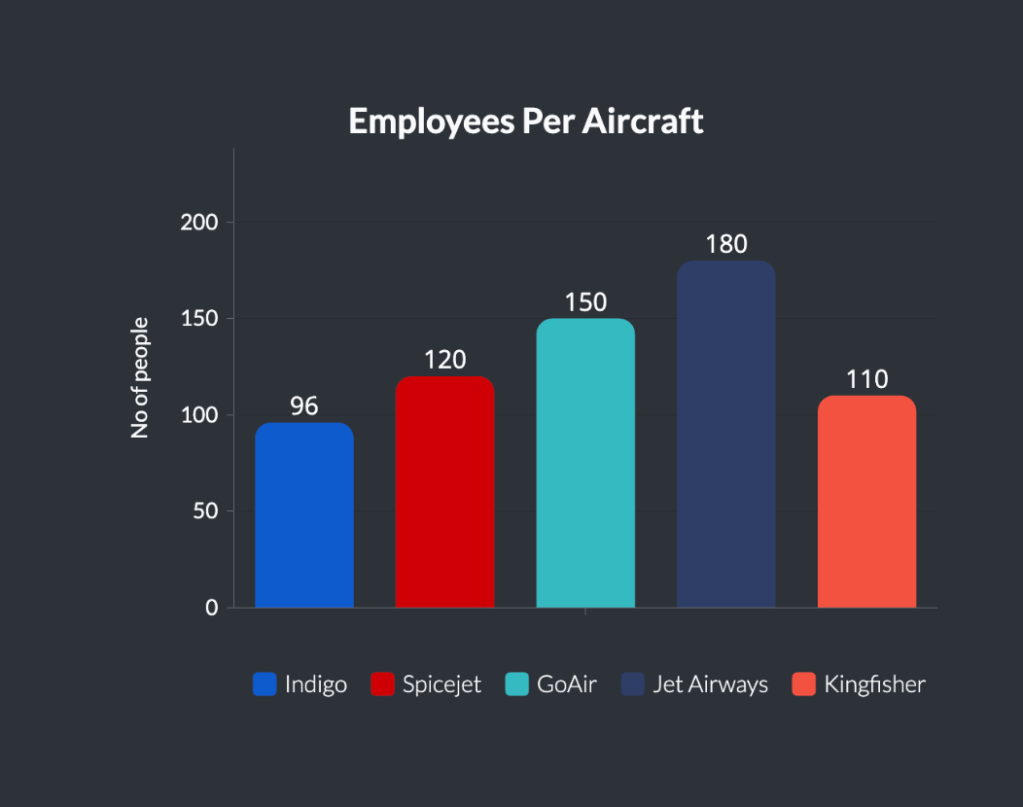

At its peak, Kingfisher Airlines held a 19.9% market share, closely matched by IndiGo’s 17.6%. However, the key difference lay in their fleet sizes. Kingfisher operated a larger fleet, resulting in higher fuel costs and greater operational expenses, which were unsustainable. IndiGo, on the other hand, achieved a similar market share with fewer planes, demonstrating the efficiency of its low-cost model and centralized operations. This contrast is highlighted in the chart below.

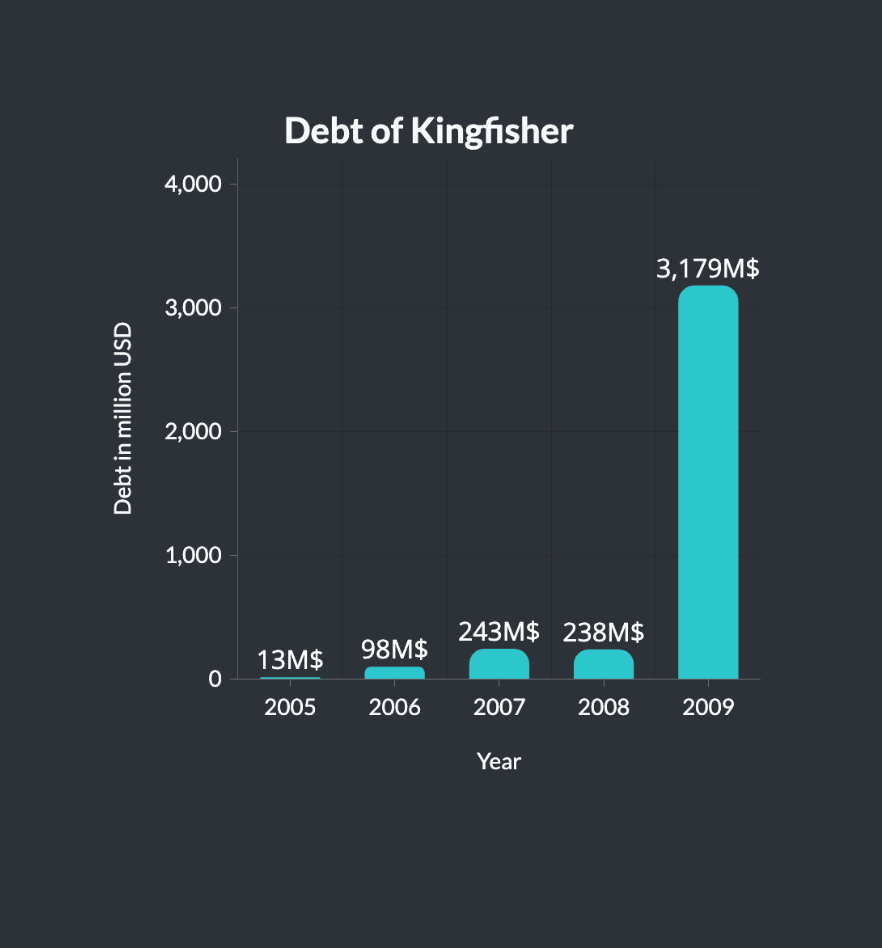

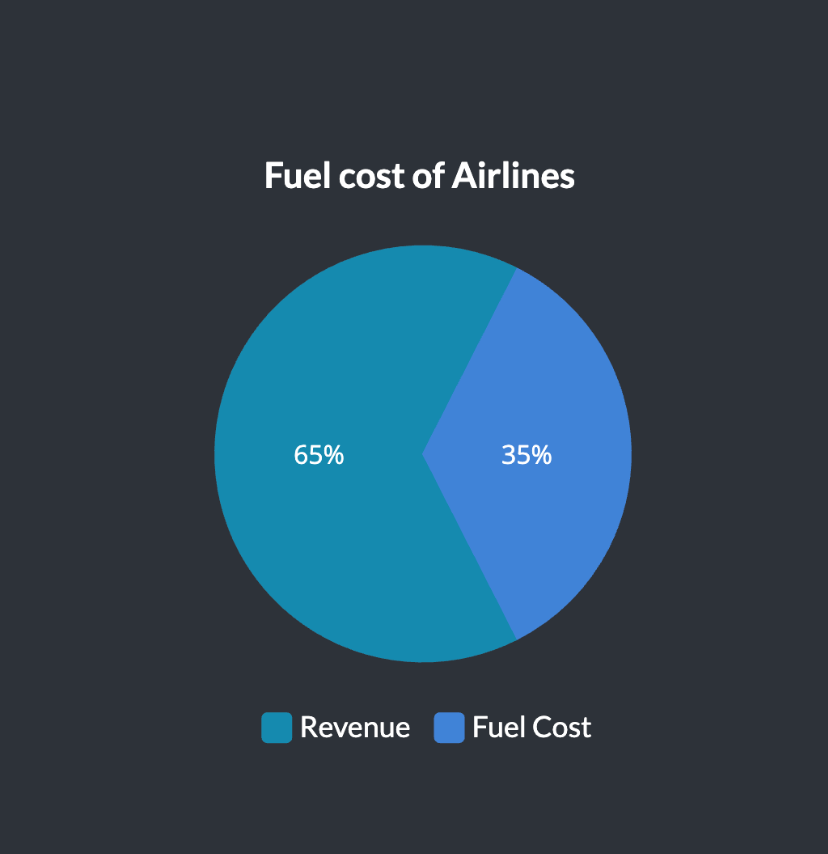

This disparity led to Kingfisher’s fuel ratio to revenue skyrocketing to 50%, an unsustainable figure. Combined with debts exceeding $3 billion USD, the airline ceased operations. Similarly, Jet Airways, which prioritized luxury over affordability, failed to cater to the Indian market’s value-driven preferences, ultimately leading to its downfall.

GoAir, on the other hand, was a low cost carrier, which was doing okay until it faced significant operational challenges due to persistent engine issues with its Pratt & Whitney-powered Airbus A320neo aircraft. By May 2023, these problems led to the grounding of 25 aircraft, accounting for 50% of its fleet. (AirInsight) This substantial reduction in operational capacity severely impacted the airline’s profitability and market presence, leading to insolvency in 2023.

So, while all the airlines fail, how did Indigo Succeed. Firstly Indigo undestood the Indian Market.

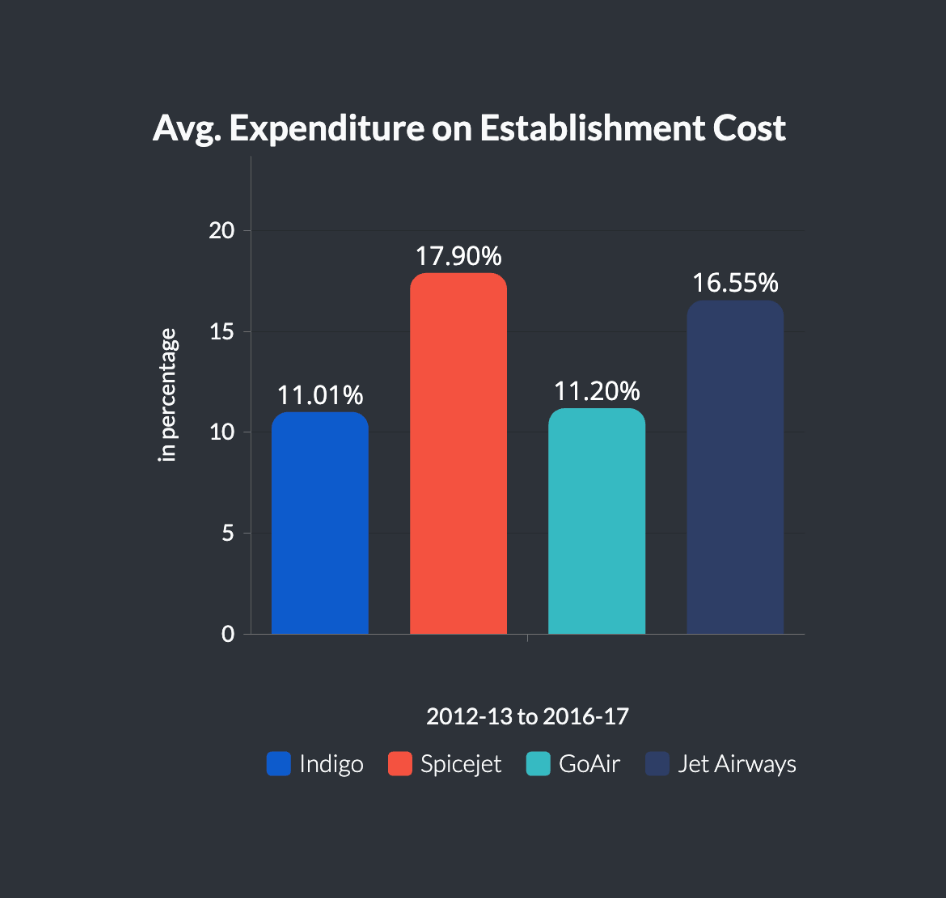

IndiGo’s success lies in its deep understanding of the Indian aviation market and its ability to learn from competitors’ mistakes. As the saying goes, “Smart people learn from their mistakes, but the real smart ones learn from others’ mistakes.” IndiGo identified the need for low-cost aviation and made strategic decisions to keep costs sustainable. They eliminated frills such as in-flight meals and IFE (In-Flight Entertainment) screens, focusing instead on affordability. With 96 employees per aircraft and an average expenditure to establishment cost of only 11.01%, IndiGo maintained exceptional cost efficiency.

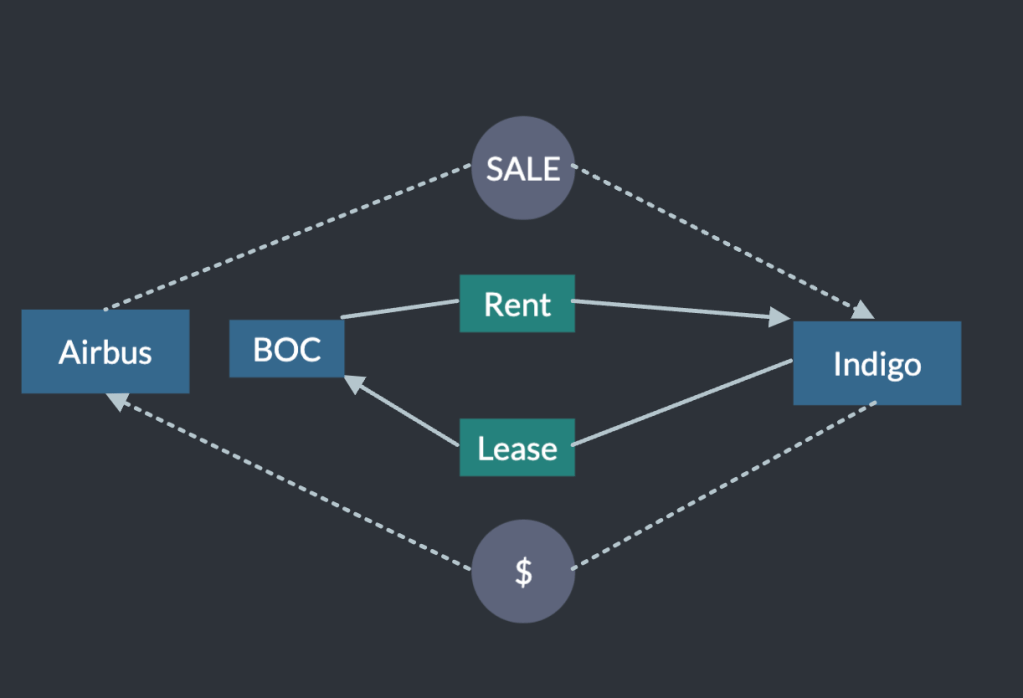

IndiGo also pioneered the Sale and Leaseback model, which became a cornerstone of its financial sustainability. By ordering 100 aircraft from Airbus in one of the largest deals in aviation history, IndiGo secured bulk discounts, reducing the cost of each aircraft by 50%. For example, an aircraft costing ₹800 crore was acquired for ₹400 crore. They then sold these planes to companies like BOC Aviation for ₹500 crore, booking a profit of ₹100 crore, and leased the planes back. This model ensured both short-term liquidity and long-term sustainability.

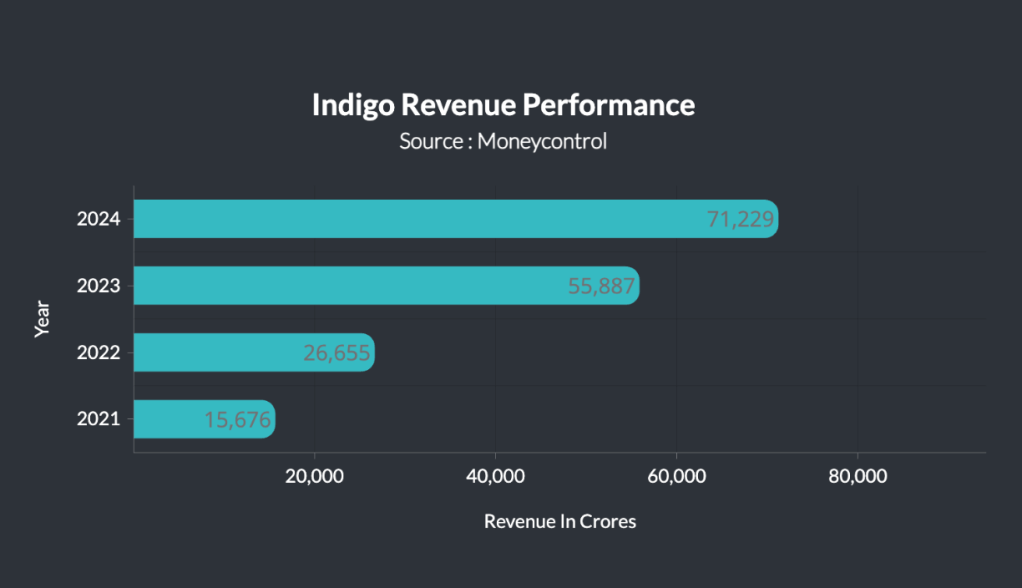

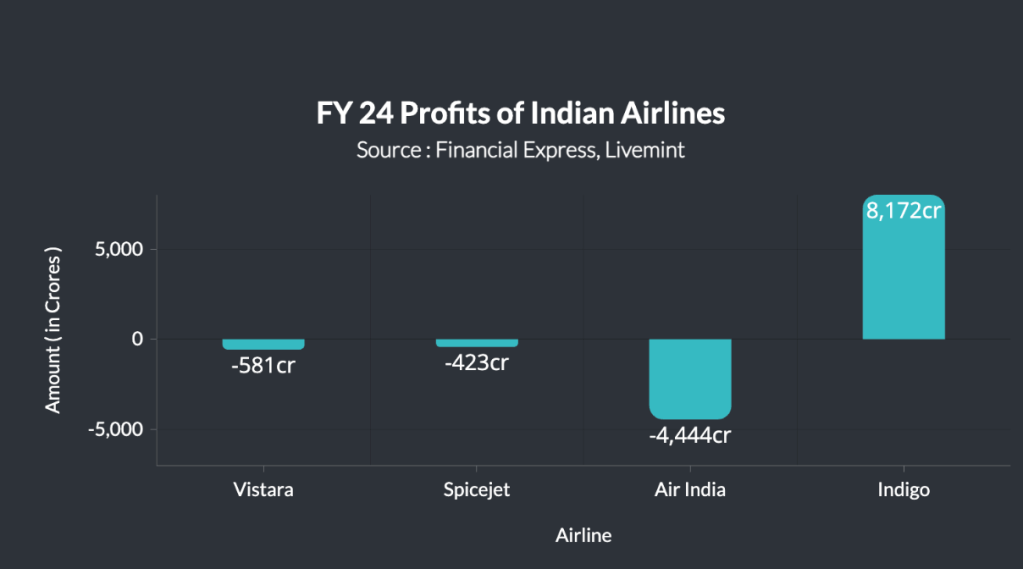

Coupled with its efficient hub-and-spoke model, IndiGo has demonstrated consistent revenue growth and, notably, was the only Indian airline to book a profit in 2024.

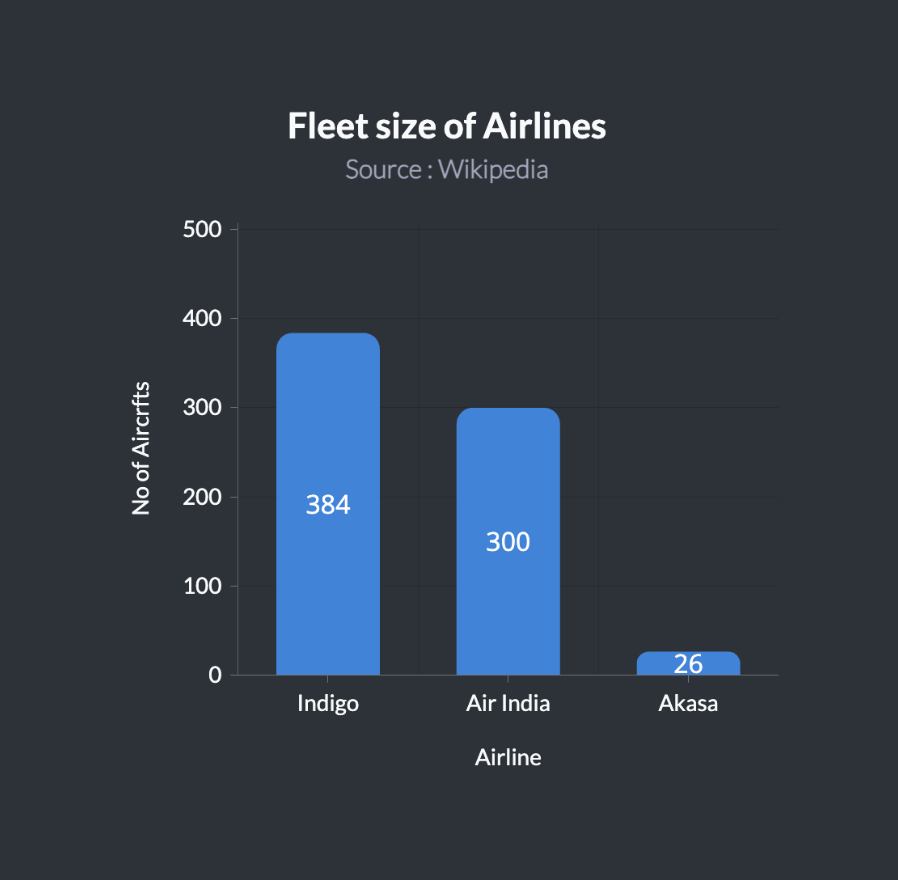

IndiGo also operates the largest fleet in the Indian aviation sector, giving it a significant operational edge.

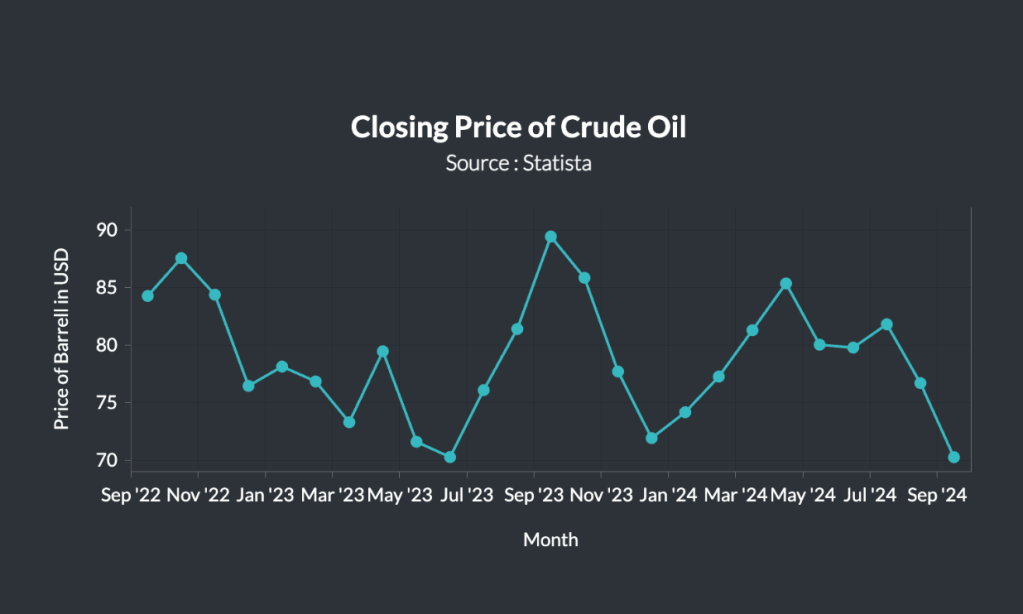

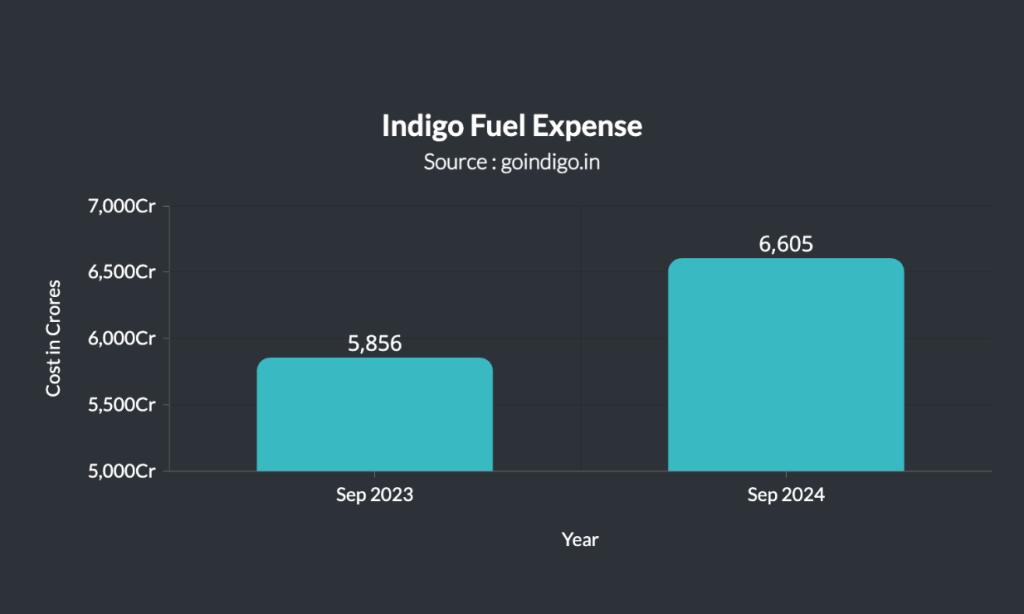

Despite IndiGo’s success, fuel prices remain a major challenge for Indian airlines. Fuel costs account for 35-40% of airline revenue, severely impacting profitability. This high dependency on fuel makes airlines vulnerable to price fluctuations.

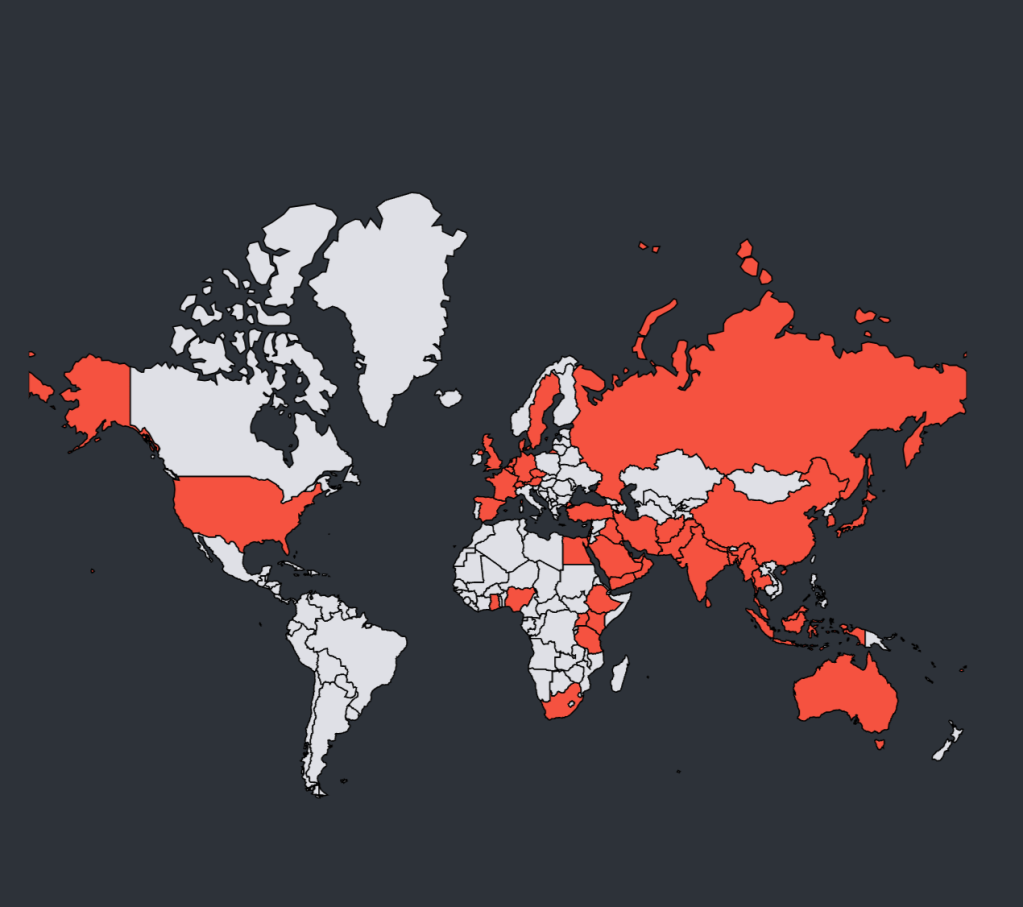

Fuel prices are also highly volatile due to geopolitical factors. With a significant portion of crude oil imported from Russia, the ongoing conflict has introduced unprecedented uncertainty, further destabilizing airline profits.

In India, VAT on Aviation Turbine Fuel (ATF) ranges from 4% to 30%, depending on the state—examples include Andhra Pradesh and Telangana with lower rates (4%) and Maharashtra and Delhi imposing higher rates (up to 30%). In contrast, globally, ATF taxes are significantly lower, often below 20% or even tax-exempt in many regions. This disparity puts Indian airlines at a competitive disadvantage, inflating costs and squeezing profit margins compared to international carriers. This has led to the cease of Operations for many airlines.

Now coming to the almost duopoly of Indian Aviation and How air India plans to Crush Indigo. Air India placed an order for 470 planes with the option to buy 370 more. Unlike IndiGo’s focus on short-haul routes within Asia, Air India’s fleet diversity includes long-haul aircraft, allowing it to dominate lucrative international markets. Air India’s consolidation of its four brands—Air India, Vistara, AirAsia India, and Air India Express—into two streamlined entities (full-service and low-cost carriers) enhances operational efficiency. The integration aligns domestic and international strategies, with a focus on premium services and price-sensitive markets. Furthermore, Air India’s investment in on-time performance (90.8% vs IndiGo’s 87.5%), customer experience, and Tata’s financial muscle positions it as a premium alternative to IndiGo’s budget model.

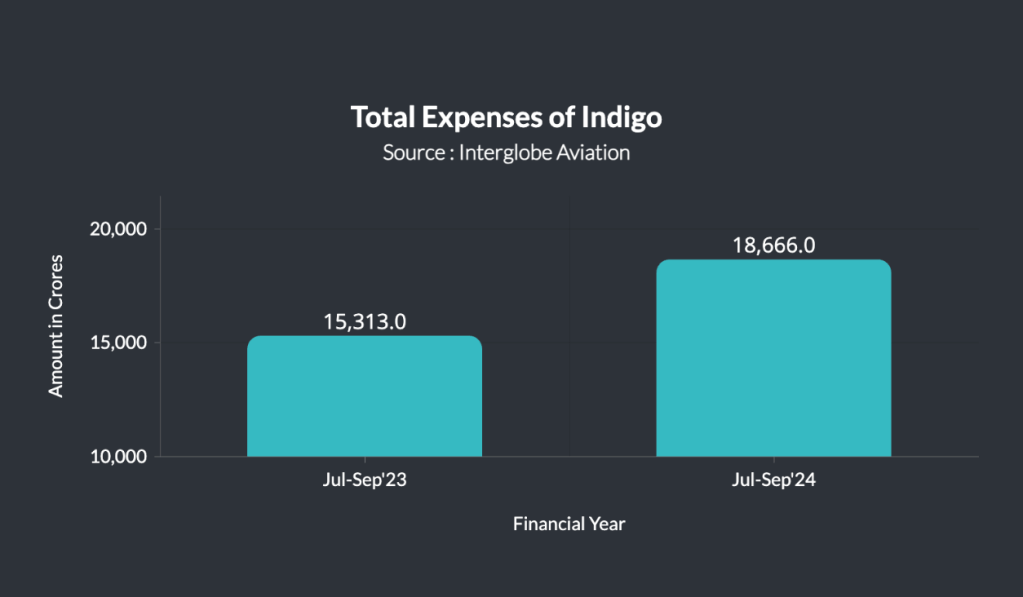

While Air India aggressively expands its fleet and operations, IndiGo finds itself navigating turbulent skies. The airline reported a staggering ₹3,000 crore increase in expenses compared to the previous financial year, driven in part by a ₹586 crore rise in lease payments.

In addition, the volatile fuel market has further strained IndiGo’s finances, with fuel costs surging by an additional ₹800 crore compared to the last financial year. The ongoing geopolitical instability, particularly the reliance on Russian crude oil, has added uncertainty to fuel pricing, exacerbating the airline’s challenges.

These escalating expenses have culminated in IndiGo reporting a net loss of ₹987 crore for the July-September 2024 quarter, marking a sharp turn from its previously consistent profitability.

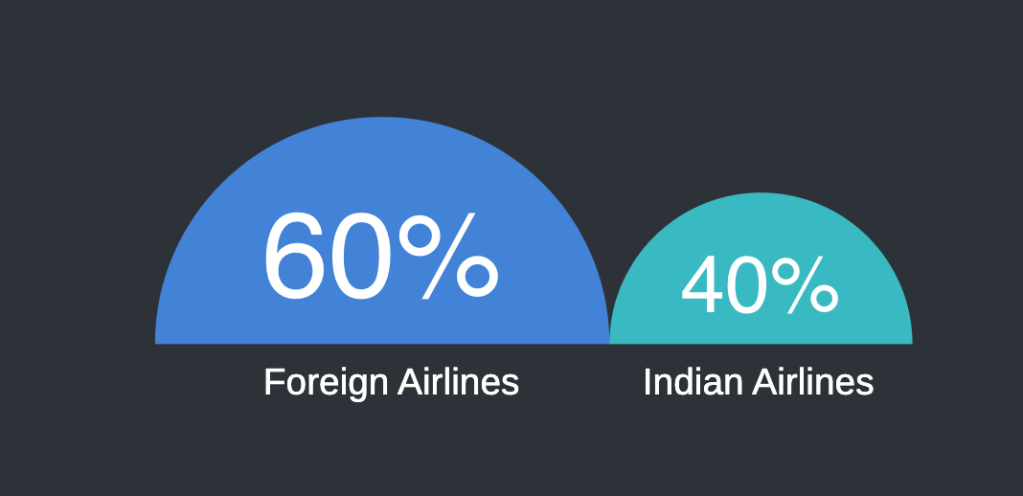

The future of aviation in India is set for unprecedented growth, driven by rising passenger demand and strategic expansions. By 2027, air travelers are projected to reach 400 million, positioning India as the third-largest aviation market globally. To meet this demand, Indian airlines must focus on international connectivity, reducing reliance on foreign carriers, which currently carry 60-65% of India’s international passengers.

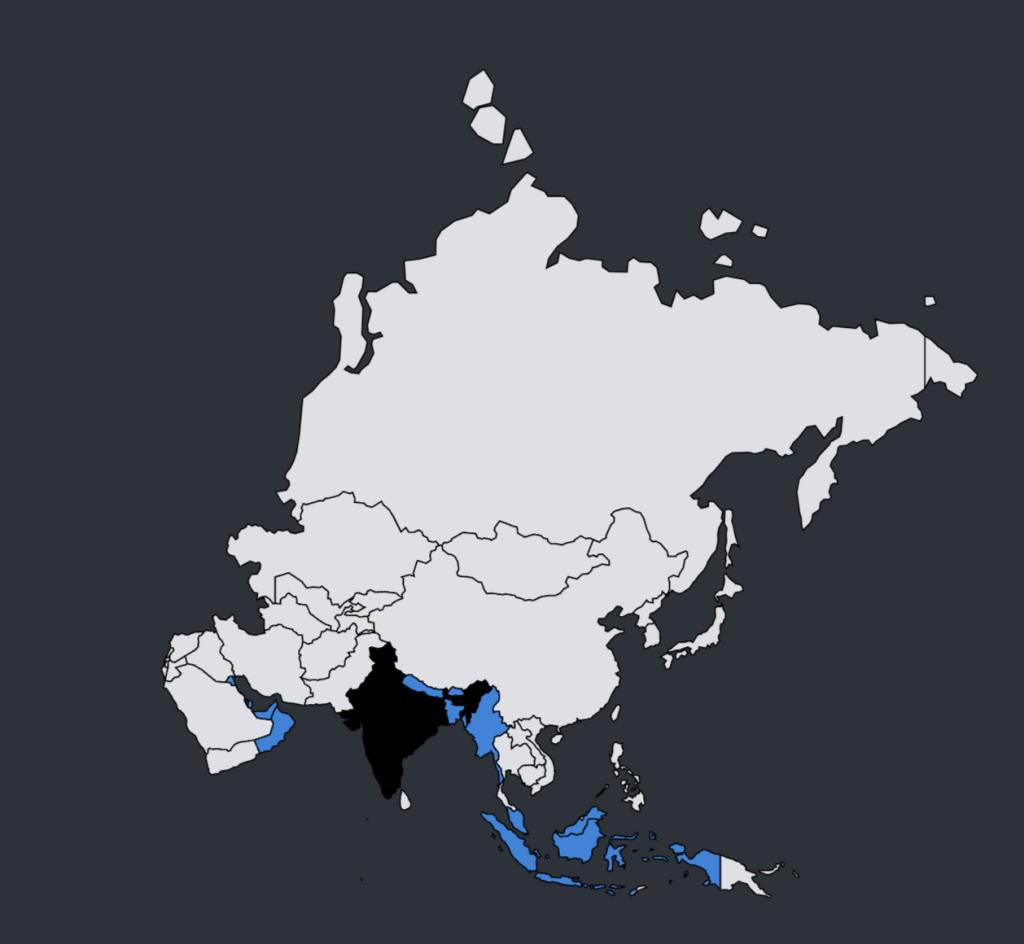

Air India, with its Star Alliance membership and long-haul fleet diversity, is well-positioned to dominate the international segment. It already serves 39 international destinations across five continents, leveraging exclusive airport slots and alliances for seamless connectivity. IndiGo, despite its dominance in the domestic market with a 58% share, has limited international reach, operating only to the edges of Asia. Expanding beyond short-haul routes is critical for IndiGo to stay competitive globally.

Operational efficiencies like route optimization and on-time performance are essential to attract international passengers. While Air India leads in on-time performance (90.8% vs. IndiGo’s 87.5%), both carriers must invest in customer experience and fleet expansion. Lowering Aviation Turbine Fuel (ATF) taxes and improving airport infrastructure will also be crucial for enabling Indian airlines to capture a larger share of international markets, boosting their global competitiveness.