Bhutan, the Land of the Thunder Dragon, is a tiny Himalayan kingdom that feels like a secret whispered by the mountains. Tucked between India and China, it’s a place where happiness isn’t just a buzzword—it’s a way of life, thanks to their famous Gross National Happines philosophy. With prayer flags fluttering in the breeze, monasteries perched on cliffs, and a culture that’s as vibrant as it is serene, Bhutan is unlike anywhere else. I’ve been lucky enough to visit twice—once with my maternal grandparents and once with my paternal ones—and each trip left me with memories I’ll carry forever.

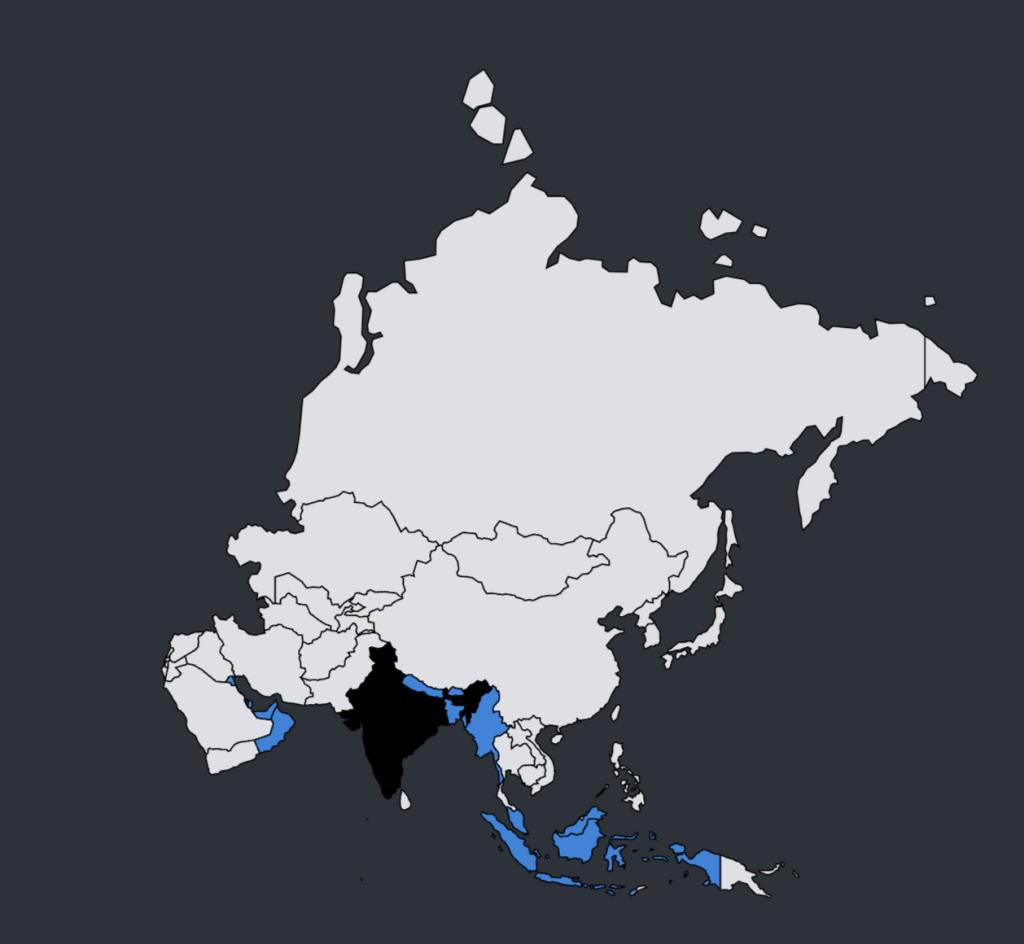

Getting to Bhutan is an adventure in itself. The easiest way is to fly into Paro International Airport, one of the most scenic (and slightly nerve-wracking) airports in the world, surrounded by towering peaks. Flights usually come from cities like Delhi, Kolkata, or Bangkok, operated by Drukair or Bhutan Airlines. If you’re feeling adventurous, you can also enter overland from India via Phuentsholing, Jaigaon, or Gelephu, though the road trip adds a few extra hours of winding Himalayan views. Once you’re in, you’ll need a visa (arranged through a licensed Bhutanese tour operator) and a guide—tourism here is tightly regulated to preserve the country’s magic.

Bhutan’s specialties? Think pristine landscapes, a peaceful vibe like nowhere, a deep-rooted Buddhist heritage, and a commitment to sustainability that’s downright inspiring. From the national animal, the takin, to the colorful festivals called tshechus, there’s something enchanting around every corner. Since I’m writing this blog years after my visits, I won’t dive into food recommendations—memory’s a bit fuzzy on the specifics—but I’ll absolutely share some Bhutanese dishes you have to try: ema datshi (spicy chili and cheese), kewa datshi (potato and cheese), shamu datshi (mushroom and cheese), and nutty red rice. Trust me, your taste buds will thank you.

So, let’s dive in!

Trip One

My first trip to Bhutan was when I was pretty young, and since my maternal grandparents weren’t big on long treks, we kept it mellow. We stuck to key sites and leaned hard into hotel life—which, honestly, was a treat. We stayed at the luxurious Taj Tashi in Thimphu, where the blend of Bhutanese design and modern comfort made every moment feel special. In Paro, we checked into Zhiwa Ling (now rebranded as Six Senses Bhutan), a stunning property with jaw-dropping views. I got miserably sick in Paro—fever, sniffles, the works—so I spent most of my time there curled up in bed, gazing out at the misty mountains. Thimphu, though? That’s where the magic happened for me. I loved the energy of the capital, the way it buzzed quietly with life, and the cozy evenings we spent sipping tea by the hotel fireplace. It was a soft landing into Bhutan, and I wouldn’t trade it for anything.

Trip Two

We followed this itenary

Day 1: Arrive in Paro, transfer to Thimphu, visit Buddha Dordenma.

Day 2: See Memorial Chorten, Changangkha Temple, Takin Preserve, Bhutan Postal Museum, Tashichho Dzong.

Day 3: Day trip to Punakha via Dochula Pass, see Punakha Dzong.

Day 4: Relax in Thimphu, enjoy pool and spa at Le Méridien.

Day 5: Transfer to Paro, visit Paro Rinpung Dzong, Kyichu Lhakhang.

Day 6: Visit Tigers Nest, stroll Paro streets.

Day 1 :Fast forward to my second trip, this time with my paternal grandparents, and I was ready to soak it all in. We landed at Paro’s postcard-perfect airport, where the plane swoops between the peaks of the himalayas. And if you’re lucky enough, you can even catch a glimpse of Everest. Our guide, Ugyen Cruise Dorji, greeted us with a warm smile and whisked us off to Thimphu on a scenic drive. Prayer flags danced in the wind, and the roads were so well-kept. I learnt that it is illegal to go to many mountains, so a lot of Bhutan is untouched and preserved, making it one of the most beautiful countries I have ever been to.

We checked into Le Méridien Thimphu, a sleek hotel with massive rooms, right in the city center—we even scored a suite upgrade. That first day, we visited the Buddha Dordenma, a giant golden statue overlooking the valley. It’s hard to describe the peace that hits you standing there, with the breeze carrying the faint sound of monks chanting. That evening, we strolled through Thimphu’s streets, popping into a local diner for dinner. The vibe was laid-back, the people were friendly, and the atmosphere were very nice. For dinner we ended up having an Italian meal in a small cozy restaurant.

Day 2 : We kicked off with a killer breakfast at the hotel—pancakes, fresh fruit and some local bhutanese delicacies. We hit the Memorial Chorten, a whitewashed stupa buzzing with locals, dressed in traditional attire, moving silently in a clockwise path around the white stupa, spinning golden prayer wheels with every step. Each spin was like a quiet wish, and I remember standing there, completely still, just observing in awe of the peace of the place. A chorten, I learned, is a type of Buddhist stupa—essentially a monument that symbolizes peace and harmony.

We then climbed up to Changangkha Temple. Perched on a hilltop, it offered sweeping views of Thimphu that made my heart skip. Next, the Takin Preserve introduced us to the takin—Bhutan’s national animal, which looks like a mashup of a goat and a cow. It’s weirdly adorable. On a family friend’s tip, we swung by the Bhutan Postal Museum, which sounds niche but was a total gem. Stamps tell stories here, and learning about GNH ( Gross National Happiness ) was a highlight—Bhutan’s all about balancing progress with well-being, and it shows.

The grand finale of the day was Tashichho Dzong, a fortress-monastery hybrid that’s pure architectural eye candy. A dzong is a traditional Bhutanese building that doubles as a religious and administrative hub, and this one was decked out with intricate woodwork and golden roofs. I could’ve stared at it for hours. For dinner, we headed to Taj Tashi for a Bhutanese feast—ema datshi, kewa datshi, shamu datshi, and red rice. The flavors were bold, spicy, and comforting all at once, and the hotel’s ambiance made it unforgettable.

Day 3 : This was long but very memorable: a day trip to Punakha. We stopped at Dochula Pass, where 108 chortens dot the hillside and the Himalayan panorama left me speechless. I also saw the himalayan peaks through a binocular which was very special. I sipped tea, snapped photos, and tried not to freeze in the crisp mountain air. Then came Punakha Dzong. Built at the confluence of the Pho Chhu and Mo Chhu rivers, the dzong stood like a guardian of time. Its wooden bridge, the colours of its windows, and the massive central courtyard were almost too perfect. I walked around, in complete awe. The place wasn’t just beautiful—it was alive. You could hear chants, water flowing, the occasional laugh, and still feel a deep, serene silence underneath it all. This was easily one of the most beautiful and picturesque places I had ever seen.

Day 4 : This day was all about chilling. We splashed around in Le Méridien’s pool, booked spa treatments that melted every ounce of stress, and wandered the city center. I snagged some lemongrass perfumes (still my favorite scent) and handmade crafts as souvenirs. Dinner was at a burger joint whose name escapes me, but that veggie burger? Juicy, flavorful, texturally perfect—hands down the best I’ve ever had. I’m still chasing that high.

Day 5 : Next, we transferred to Paro, stopping for a bird’s-eye view of the airport that made me gasp all over again. We stayed at Naksel Boutique Hotel & Spa, a gorgeous spot with Himalayan vistas that felt like a hug from nature. It’s a bit off the usual path, but that just added to the charm. That day, we explored Paro Rinpung Dzong—another breathtaking fortress—and Kyichu Lhakhang, one of Bhutan’s oldest temples. The serenity was unreal.

Day 6 : Our last day was low-key. Tiger’s Nest (Paro Taktsang) loomed above us, but with my grandparents along, we skipped the steep hike and saw the monument from below. Instead, we strolled Paro’s streets, soaked in the Himalayan views from our hotel, and let the trip sink in. It was the perfect goodbye.

Bhutan’s a place that sneaks into your soul. Whether it was sipping tea at Dochula Pass, marveling at dzongs, or just breathing in that crisp mountain air, every moment felt like a gift. There is this peace about Bhutan, a kind of serenity, which I haven’t felt anywhere else. It’s a country that doesn’t dazzle with spectacle—it humbles you with silence, with balance, with intention. My two trips—one gentle, one immersive—showed me different sides of this kingdom, and I’d go back in a heartbeat. If you’re craving a mix of adventure, culture, and peace, Bhutan’s calling your name. Just don’t ask me for burger joint specifics—I’m still kicking myself for forgetting that name!